Lessons from Pharma and Payer Sectors

Omnichannel ROI Series Part I

Here’s a challenge I see repeatedly when leading digital transformation across pharma and payer organizations: it’s difficult to tie CX and omnichannel success metrics to business ROI. CX teams speak the language of NPS scores, CSAT scores, and engagement rates, while senior executives across the enterprise demand proof of revenue growth, cost reduction, and competitive resilience before approving investment and capital. This series provides a practical framework for bridging that gap

The Vanity Metrics Trap

I’ve sat through countless executive presentations where impressive engagement numbers leave leadership unmoved. The problem isn’t the data—it’s the disconnect between what we measure and what matters to decision-makers. Many senior leaders don’t know what CSAT, NPS, or CES scores are, let alone what they mean for the business.

Common Pharma Metrics That Don’t Tell the Full Story:

Email open rates and click-through rates from HCP campaigns, website session duration on medical information portals, content downloads of clinical resources, rep activity counts logged in CRM systems, and virtual event attendance numbers. While these metrics indicate engagement, they fail the “so what?” test. If your HCP email engagement is up 40%, what does that actually mean for market share or patient starts?

Common Payer Metrics That Fall Short:

Member portal login frequency, mobile app downloads, call center deflection rates without quality context, provider portal registrations, and newsletter subscriptions. The underlying issue is stark: 56% of US online adults with health insurance feel that their health insurer should do more to help them understand healthcare costs, while over 40% find their insurer’s financial forms difficult to understand.2 Traditional engagement metrics often mask these fundamental CX failures.

These metrics matter as directional indicators, but they’re insufficient for justifying budget or proving strategic value. The fundamental issue: they don’t answer the executive question of “what business problem does this solve?”

The Business Outcomes That Actually Matter

Through my work with both pharmaceutical and payer organizations, I’ve identified a consistent pattern: successful CX leaders align their initiatives to outcomes that executives already care about. Here’s the framework I use:

For Pharmaceutical Organizations:

Commercial teams focus on prescription volume (TRx and NRx), revenue, and market share in target segments. Medical Affairs prioritizes appropriate prescribing based on clinical guidelines, treatment persistency improvements, investigator engagement for clinical trials, and guideline adherence in target populations. Patient Services tracks enrollment rates in support programs, authorization success Rate,medication adherence rates, and patient satisfaction with support.

For Payer Organizations:

Member experience teams measure metrics like member retention and churn rates, member satisfaction score, and benefits utilization optimization, etc. Clinical outcomes focus on preventive care completion rates, chronic disease management metrics (HbA1c control, blood pressure management), emergency room utilization reduction, and hospital readmission rates. Operational efficiency emphasizes cost per member per month (PMPM), administrative cost ratio, call center cost per contact, and prior authorization processing time. For many payers, strategic goals include reduction in cost of healthcare, improvement in quality and outcomes of care, and improved access to care.

These outcomes align with what industry research identifies as the four pillars of value: revenue growth, operational efficiencies, health outcomes and medical cost savings, and time to value.1

Building the Connection: From Engagement to Business Impact

One effective approach requires mapping the pathway from digital touchpoints to behavior change to business results. The key is ensuring this orchestration is measurable at each stage.³ Interestingly, payers are often ahead of pharma in this regard—years of managing member journeys across enrollment, claims, care management, and service touchpoints have built organizational muscle for omnichannel thinking that many pharmaceutical companies are still developing.

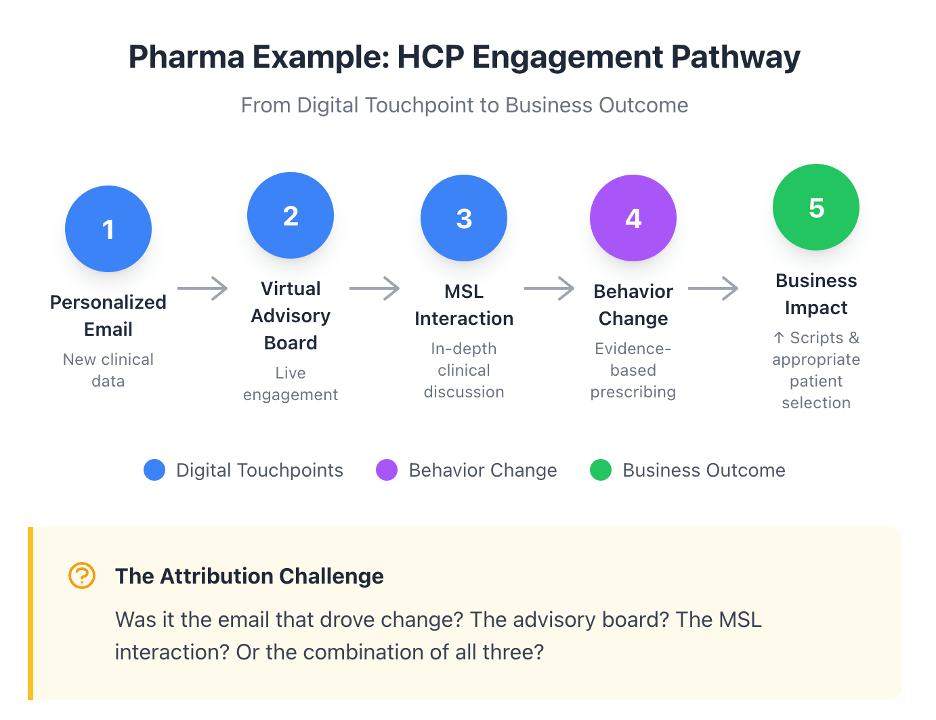

Pharma Example Pathway:

Here’s a high-level example to illustrate the concept: An HCP receives a personalized email about new clinical data, attends a live virtual advisory board, and engages with an MSL for in-depth clinical discussion. This journey culminates in changed prescribing behavior—resulting in increased script volume and more appropriate patient selection.

This is where attribution—the ability to assign credit to specific touchpoints for driving an outcome—becomes critical. Did the email spark initial interest? Did the advisory board build conviction? Did the MSL close the loop? Or was it the cumulative effect of all three? Answering these questions determines where to double down and where to cut.

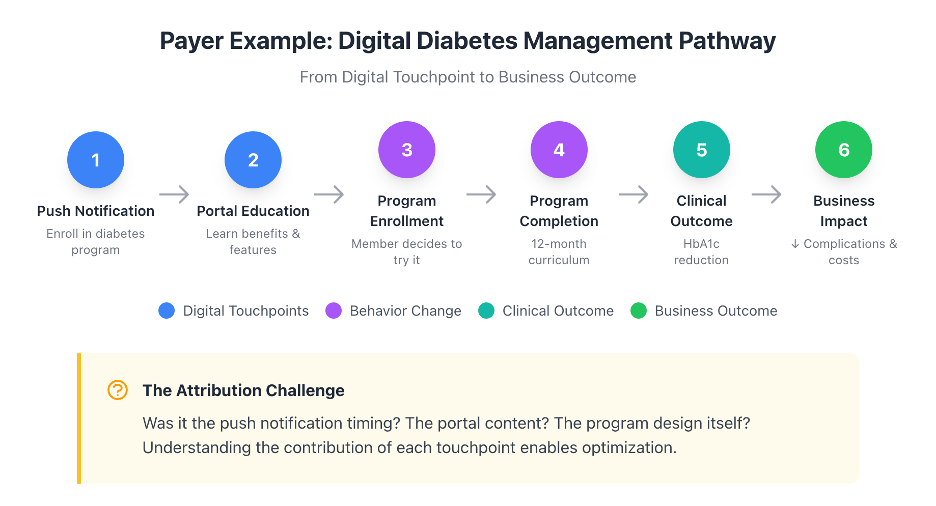

Payer Example Pathway:

Here’s an example from the payer side: A member receives a push notification through the payer’s mobile app prompting them to enroll in a digital diabetes management platform. They log into the portal to learn about the program’s benefits and features, decide to give it a try, and enroll. Over the next 12 months, they complete the program and achieve a clinically significant HbA1c reduction—ultimately leading to fewer complications and lower medical costs.

The attribution challenge here is equally complex: Was it the push notification timing? The portal content? The program design itself? Understanding the contribution of each touchpoint enables optimization.

Understanding these pathways is important, but without solving the attribution challenge, optimization is impossible. How do you know which channels to invest in? Which touchpoints to scale? Which to cut? In the next article in this series, I’ll share four practical measurement approaches that organizations are using to connect engagement to business outcomes—with real use cases from both pharma and payer.

Next in this series: “The Omnichannel Metrics Playbook: Adapting E-Commerce KPIs for Pharma and Payer“

References

- League Inc. 2026 benchmark report reveals health plans struggle to measure CX ROI effectively. PR Newswire. December 9, 2025. https://www.prnewswire.com/news-releases/2026-benchmark-report-reveals-health-plans-struggle-to-measure-cx-roi-effectively-302635683.html

- Weader J. It’s time to tell the healthcare CX story in terms of ROI. Forrester. August 8, 2023. https://www.forrester.com/blogs/its-time-to-tell-the-healthcare-cx-story-in-terms-of-roi/

- Roy A, Roy S. Omnichannel engagement in pharma: harnessing the power of generative AI. IQVIA. October 14, 2024. https://www.iqvia.com/blogs/2024/10/omnichannel-engagement-in-pharma

Leave a comment